Marc Marshing has published a short book on using customer data in financial analysis. (I am assuming it was a dissertation or similar as it is closer to a paper than a traditional book). He talks about adding customers to ratios, specifically adding a measure of customer value to the price to book ratio. This is an interesting idea and one certainly worth taking further. He also helps illustrate some of the confusion in the field that we really need to get rid of.

The Confusion Over Customer Equity

The first thing that is very noticeable is the problem we have got ourselves in regarding defining customer equity. I am not a fan of the term, customer equity, for a number of reasons. An obvious one being definitions are all over the place. People use customer equity for the sum of all a firm’s CLVs (Customer Lifetime Values). Then they subtract acquisition costs before reporting CLV. What the resulting number means is anyone’s guess. It certainly isn’t an asset as has been claimed. It confuses me despite the fact that, as a marketing professor and qualified accountant who has studied the area, you’d hope I’d be able to make some sense of it.

CLV And Acquisition Costs (Again)

Marshing is using customer equity in the widely used sense, as the sum of customer lifetime values. He first tells us that CLV integrates acquisition cost.

While different approaches are possible, all CLV models have the common goal of calculating “the present value of all future profits obtained over the life of [its] relationship with the firm” (Gupta & Zeithaml, 2006, p. 724) by integrating the components customer acquisition, retention and cross selling.

Marshing, 2017, page 6

I believe this captures some views in the field but it is simply wrong. That “All” CLV models integrate acquisition is clearly incorrect. We have a book on marketing metrics that does not do this. The book has been in publication since 2005. I have articles on the subject, such as my Sloan, see here. Here is a piece I did back in 2013 for this website. The MASB definition does not do this, see here.

Our Book: It Exists And Has For A Long Time

People Miss Things, Even In Their Own Small Book

Still, people miss things. How can I be sure that Marshing doesn’t even agree with what he wrote? Marshing tells us later, correctly, that the math doesn’t work if you include acquisition costs. So he is going to use the formula from Phil Pfeifer (my old Darden professor) which does not integrate acquisition costs.

Also, note that acquisition costs are not included.

Marshing, 2017, page 26

Not to be too pedantic but Phil’s approach works precisely because it doesn’t do what Marshing says all formulas do — and that is integrate acquisition.

Confusion About Customer Equity

I don’t want to be too negative. I believe Marshing is merely reflecting the field. We are collectively confused about customer equity, see more here. As such, why wouldn’t someone summarizing the field give a confused view? In some ways, you could argue he had to show confusion to summarise things properly. Marshing even explicitly notes that there is confusion in the field.

…the concept of CE [customer equity] is very vague because it is not clear which customers it is based upon. This paper, [Pfeifer 2011] therefore, distinguished between the CE of existing, future and total customers.

Marshing, 2017, page 26

This makes a lot of sense. The idea of future customer equity is fraught with challenges. I’m not saying the issue of the value of prospects is not very important. Still, I think that we need to distinguish it from CLV. The undeniable point is that if we want to understand the value of customers it is important to know what we mean. For example, it is useful to know who the customers we are valuing are. The customers in your database are a great place to start for many firms.

Adding Customers To Ratios

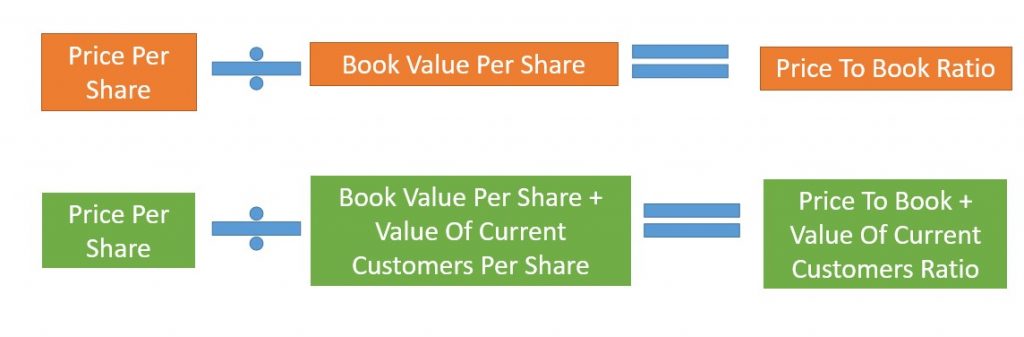

I like Marshing’s basic idea in adding the value of (current) customers to the Price to Book ratio. Basically, he increases the book value per share for the value of current customers attributable to each share of the firm. (My picture below changes his idea a little, mainly avoiding terms I don’t like much). The new metric adjusts for the value of some omitted assets. The fact that we are using current customers — a number for whose lifetime value we can calculate with at least some confidence — makes it more credible. This is the sort of number an accountant could think was reasonable.

Overall, Marshing’s work is helpful in that it advances the field while also neatly illustrating how far we still have to go.

For more on CLV see here and customer equity see here.

Read: Marc Marshing (2017) Customer Relationships, Customer Equity And Intangible Assets, AV Akademikerverlag