There were several papers, and a book, that followed but Sunil Gupta and Donald Lehmann had a really interesting 2003 piece in the Journal of Interactive Marketing. This was about treating customers as assets. Much of the best ideas in this field are already on show there in this early paper.

Marketing And Firm Value

An explicit focus of this paper is linking the value of customers with firm value. If we think of customer (relationships) as assets the linkage seems obvious. Still it can be hard to show the link. The authors thus developed ways to translate data about customers into some sort of value of the customers as a whole. This paper is in the tradition of linking marketing to Wall Street. (More so, to my mind, than linking marketing to strategic management in the firm).

Where Did They Go For Their Base Models?

Much of the original work they were building on was from direct marketing.

..the concept and models of customer lifetime value originated in the field of direct and database marketing….

Gupta and Lehmann, 2003, page 10

The authors suggest that the idea had somewhat got stuck there which seems reasonable to me.

While this is of great value to database marketing professionals, it appears to be of limited value to senior managers who are concerned with strategic decisions, or investors who do not have access to internal company data.

Gupta and Lehmann, 2003, page 10

To allow for wider usage the authors suggest a formula which can be used with limited data.

Assumptions In The Formula

One of the things I appreciate in this work is that the assumptions are so clearly laid out. The formula assumes constant average margins, and constant retention. The authors cleverly get away from assuming the length of the relationship by using an infinite life model. In this retention and discounting mean that the far future becomes largely insignificant.

Later criticisms have argued that this formula is wrong. While the assumption of constant margins doesn’t fit with a lot of reality the criticism seems a little unfair to my mind. The formula is what it is. Gupta and Lehmann say CLV has not been used much as it is too complex. They are simplifying with a model. The simplifications may not work in a lot of situations but they are trying to address a serious problem. I still think treating customers as assets hasn’t broken through as much as it should have. I would argue this remains because the mechanics are often too complex and the arguments too esoteric. (As well as contradictory ideas all being listed under the CLV banner). This paper is a brave attempt to tackle a serious problem in a relatively practical way.

The authors have practical ideas on how to look at the value of firms through their customers. They developed these further in later work and there are things that aren’t perfect yet still this is impressive stuff.

Treating Customers As Assets: Acquisition Costs

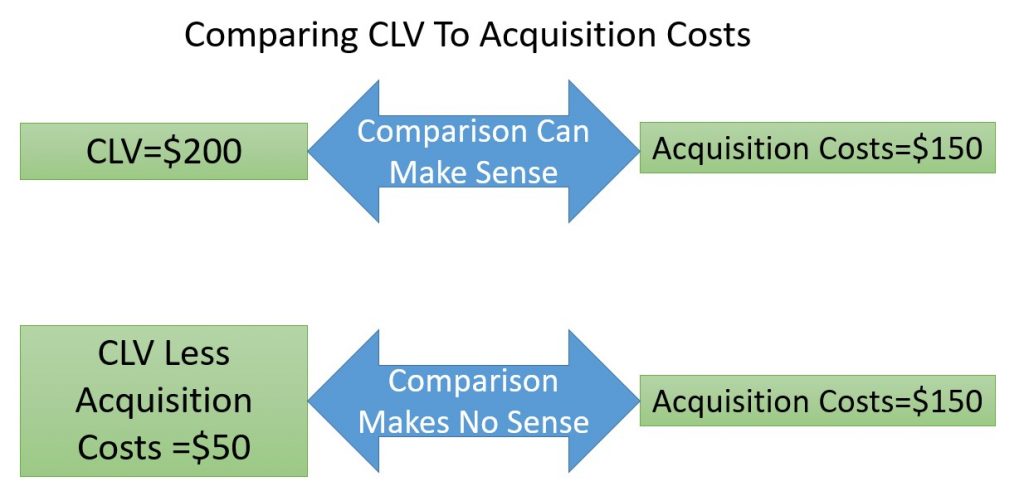

As ever on CLV I would note that if you are looking at customers as an asset you shouldn’t subtract acquisition costs from the value of CLV before reporting it. This is a confusing issue in a lot of the later literature. Still I would note that Gupta and Lehmann seem to have got it right first time. (Things get messier later in their work. I don’t know but I would guess they always knew what they were doing but maybe they were bullied later by reviewers into doing things that didn’t make sense).

The formulas they present do not refer to acquisition costs although sometimes what is meant by marketing costs can be hazy. Here we are lucky as the intent of the authors is clear. We can conclude that Gupta and Lehmann meant CLV to be before subtracting acquisition costs given what they write.

However, common sense suggests that to acquire a customer, a company should not spend more than the lifetime value of that customer.

Gupta and Lehmann, 2003, page 14

Therefore, our best estimate of its customer lifetime value is $961.48, significantly above its acquisition costs of $391.

Gupta and Lehmann, 2003, page 15

Neither of these sentences make sense if you subtract acquisition costs before reporting CLV. Comparing a number net of acquisition costs with acquisition costs would be a completely meaningless comparison.

Gupta and Lehmann got us off to a great start. Sadly it has been a bit two steps forward one step back since.

For more on CLV see here.

Read: Sunil Gupta and Donald R. Lehmann (2003) Customers As Assets, Journal of Interactive Marketing, 17 (1) pages 9-24