Marketers, and business people more broadly, often use accounting profit to measure success. This isn’t too surprising. Often firms claim to be profit maximizing. Report something as profit and this sounds like something that should be maximized. That said, profits using in accounting and managerial decision-making are not really the same thing. Decisions taken to maximize accounting profit don’t necessarily maximize economic profit.

Accounting Profit Does Not Equal Economic Profit

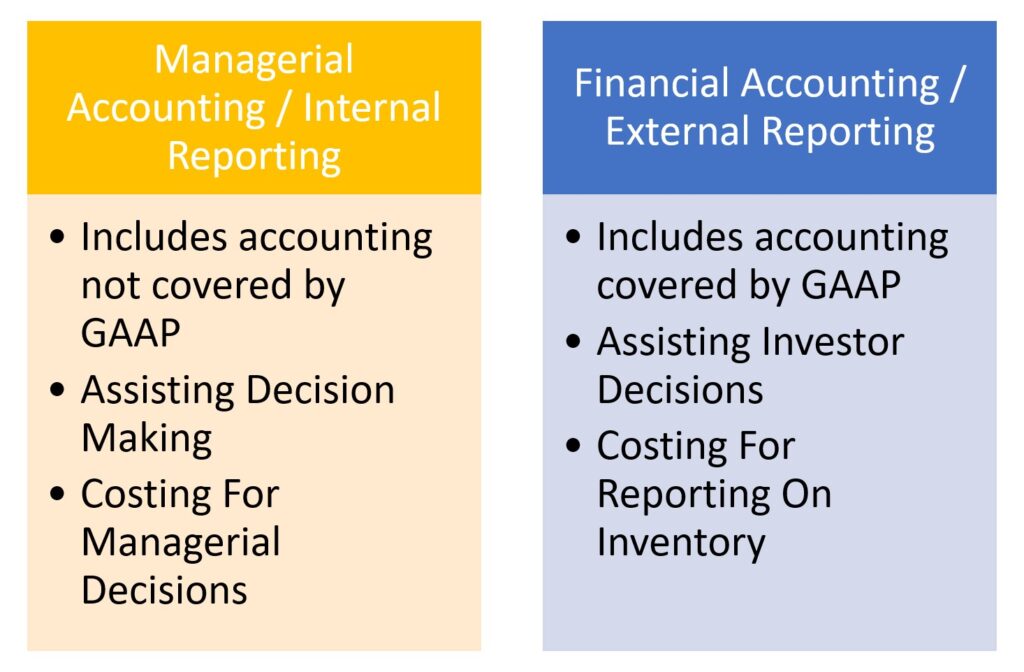

It seems like accounting and economic profit should be the same. Yet they aren’t. Indeed these two “profits” are especially likely to diverge in the short-term. This isn’t because accountants are silly. Nor is it for any sinister reason. Financial accounting standards are there to assist decisions just not managers. Financial accounting rules are there for investors and creditors. Anything that helps investors’ decisions is adopted by financial accounting standards, anything that doesn’t is ignored. The rules are there for defensible reasons. Just always remember they are not there to help managerial decisions.

Purpose Of Financial Accounting Statements

As the International Accounting Standards Board (IASB) concepts state:

The objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders and other creditors in making decisions about providing resources to the entity.

IASB, 2010, page 1

Accounting For Profits And Decisions

The logic is that the managers don’t need external reporting. They should already know what their economic profit is. They should be able to take sensible risks based upon the information they already have.

The accounting profit reported only aims to help investors make good investment decisions. The external financial statements therefore deliberately ignore economic profit. For instance, they take an excessively risk-averse posture.

When standards setters set financial accounting rules they have something in mind. The rules are there to limit the risk of overstating the external financial accounts. They try and avoid the investor buying something at too high a price. The same rules therefore accept the risk (actually the near certainty) of understating the accounts. Thus rules helping external decision-makers usually understate values. This makes values from financial accounting statements inappropriate for internal decision makers attempting to make (economic) profit-maximizing decisions.

Internal Reports Should Not Follow External Reporting Rules

The key idea is that when making an internal decision use information designed to facilitate that decision. This is perfectly acceptable, internal accounts don’t need to follow external accounting rules. Indeed they shouldn’t.

My summary: when accounting for profits and decisions remember accounting profit is not economic profit. Nor is it meant to be. If you are trying to maximize economic profit then don’t use information uncritically based upon the external financial statements.

For more on managerial accounting for marketing see here and on marketing accounts see here.

Read: International Accounting Standards Board, (2010) The Conceptual Framework for Financial Reporting (this was revised in 2018)