Leiser and Shemesh consider the problem that the public makes a lot of judgments that rely on economic knowledge. Still, it isn’t always clear that the decisions are made with great knowledge of economics. Indeed I would go as far as to say that the authors are disappointed in the rest of us. They show a bunch of examples where the public has a fairly rudimentary knowledge. We are misunderstanding economics. They are almost certainly correct that the knowledge the general public has about economics is far from impressive.

Does Anyone Understand Macro-Economics?

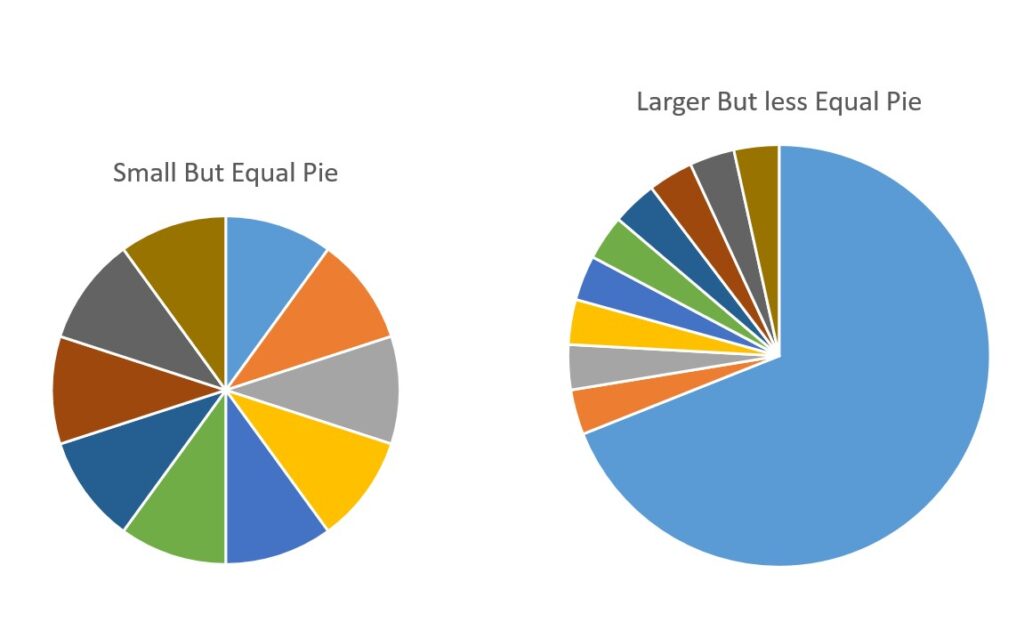

That said the book remains a challenging one to write. Most of the book focuses on macroeconomic policy problems. In this area, it is pretty hard to “prove” what is correct. The economy is messy. Therefore, finding a simple, X did this and so Y happened is hard. Economic orthodoxy might suggest rent controls will cause problems in a market. Yet, it is hard to prove definitively that rent controls aren’t socially desirable. Especially given, as the authors point out, people have idiosyncratic personal preferences about the objectives of running the economy. Should we try and make the pie as big as possible regardless of who gets what slice of the pie? Should we concentrate more on fair shares of a pie that might be smaller? People will come to different conclusions.

Misunderstanding Economics

It is much easier to show the public’s ignorance by relying on questions with clear mathematical answers. If a person doesn’t understand the concept of compound interest they are clearly lacking in economic knowledge. Although even if people do not understand it well the consequences of not understanding compound interest are sometimes not clear. If we neglect to save is it because we lack knowledge or are we simply too impatient?

Most smokers understand that their habit isn’t good for them but they do it anyhow. With macroeconomic policy decisions, it is even harder to show why we collectively make the choices we do. The economy is horrendously complex. The average person’s decisions don’t individually make much difference to the economy. It is too strong an assumption to assume that simple effects — lack of individual knowledge — aggregate to poor overall consequences without testing this. (One of Leiser and Shemesh’s key complaints is that the economy has complex interactions that require deep thinking that the public’s superficial assumptions — e.g., going into debt is bad — don’t capture.)

Ideally We’d Be Better Informed

That said, in an ideal world the public would be better informed. There would be less misunderstanding economics. Given that we aren’t well informed is tricky to know what to do. They conclude that people just don’t know enough to make good decisions but concede that “its implications for policy are far from clear” (Leiser and Shemesh, 2018, page 129). They have a few ideas that could make things a little better but it isn’t a very upbeat ending. It would be nice if it were a bit chirpier. (Not saying it should be, but it’d be nice).

For more problems understanding the world, see here, here, here, and here.

Read: David Leiser and Yhonathan Shemesh (2018) How we misunderstand economics and why it matters: The psychology of bias, distortion and conspiracy, Routledge