What is the marketing response to stock market pressure?

Myopic Management

Myopic management/marketing is the tendency to focus on short-term gains at the expense of long-term profits. It can occur for a number of reasons. Yet, at its heart, pressure from Wall Street appears to drive myopia for public companies. Certainly, many scholars subscribe to this view. Views differ on how strong the pressure from Wall Street is. But, if one is willing to assume any sort of market inefficiency, then it might make sense to cut long-term investments (marketing, R&D). This can boost the short-term bottom line. (This is the concern at the heart of worries that marketing isn’t well accounted for). Marketers worry about short-term actions that don’t make sense long-term.

Marketing Response To Stock Market Pressure

Anindita Chakravarty and Raj Grewal looked at how such pressure impacts marketing and R&D budgets.

..we investigate whether concerns for shareholder returns drive marketing budgets.

Chakravarty & Grewal, 2011, 1595

They argue that managers react to past stock performance in setting current budgets.

The authors focus on past performance through Stock Returns (how well the stock did) and Stock Volatility (how much the return varied). Generally, people dislike surprises. As such, the authors use a logical argument. That we will see the adoption of “strategies that can help managers avoid unpredictable earnings shortfalls in the short term” (Chakravarty & Grewal, 2011, 1597).

How to do this?

The most direct way to ensure that short-term earnings meet or exceed the expectations developed in prior periods is to make unanticipated reductions in R&D and marketing budgets simultaneously.

Chakravarty & Grewal, 2011, 1597

A Moderate Form Of Myopia

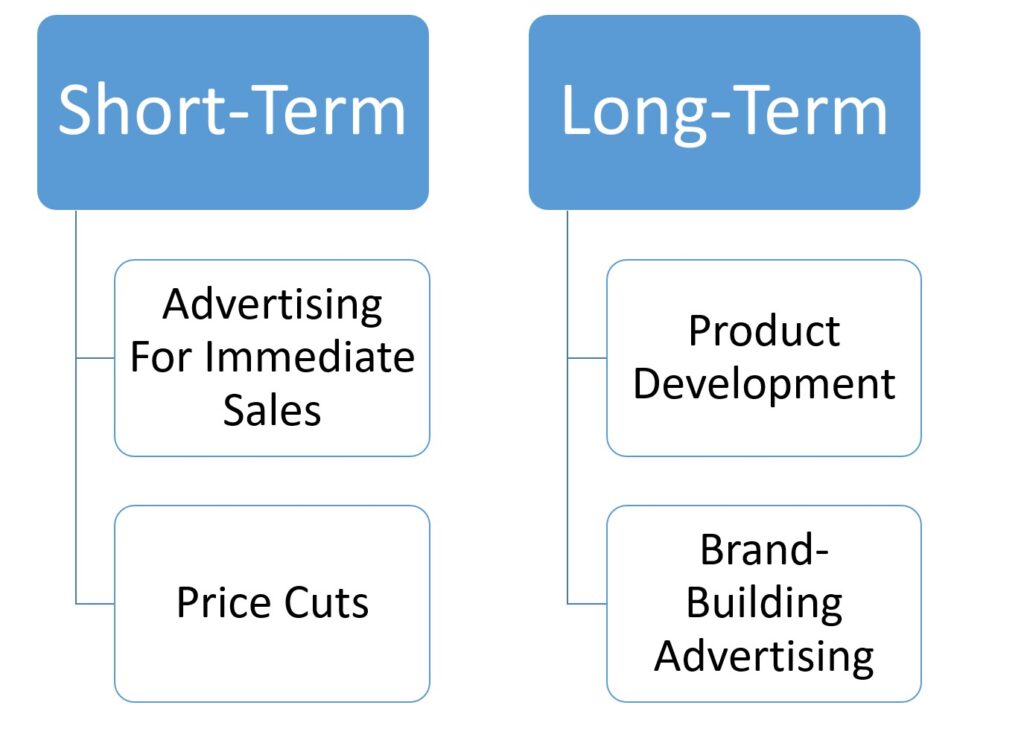

Contrary to full-blown (“high level”) marketing myopia the authors suggest that managers might cut R&D. The managers will invest in some different types of marketing instead. Basically, they will invest in the sort of marketing expected to show a short-term return. This might be advertising or short-term promotions.

Research into marketing budgeting seems vital to me. It is hard. The authors have to use advertising spend as a proxy for all marketing spend. This is imperfect. It may be as good as is achievable with current data. The authors do a content analysis of managerial reports. This gives some additional evidence to support that value appropriating marketing, e.g., short-term promotions, is increased.

Increase In Short-Term Activity

Overall, they find “high frequencies of unanticipated decreases in R&D”. They also observe increased marketing budgets. We might say that this implies moderate levels of managerial myopia. The direct cuts are limited. Still there are concerns.

Among the marketing activities that increase, promotions tend to be short-term oriented.

Chakravarty & Grewal, 2011, 1606

It perhaps isn’t the dramatic cutting of value creation budgets that some may have expected. The authors find that short-term marketing is increased. This does suggest the possibility of a notable drag on long-term profits. There is mis-prioritizing budgets due to stock market pressure. Marketing spend isn’t as good as it could be.

Given their findings it is hard to disagree with their suggestion.

Corporate governance regulations also might mandate that managers disclose their R&D and marketing budget allocation strategies in detail…

Chakravarty & Grewal, 2011, 1607

It would be great to have an even better understanding of this important topic.

For more on marketing and the stock market see here, here, and here.

Read: Anindita Chakravarty and Rajdeep Grewal (2011) The Stock Market in the Driver’s Seat! Implications for R&D and Marketing, Management Science 57 (9), pp. 1594–1609