Customer Lifetime Value (CLV) is a great thing to calculate. It encourages marketers to take the numbers seriously. It helps finance people see the numerical basis of marketing. Calculating CLV encourages you to treat customers well; they are valuable and you have the numbers to prove it. Finally marketing’s influence probably increases when people think of a firm’s value as based upon the sum of the values of its customers. (My description here is little simplistic, firm value is more complex, but the general idea is powerful.) Phil Pfeifer (my old Darden professor) and Anton Ovchinnikov look at the issue of CLV And Limited Capacity.

CLV As A Guidepost From Acquisition

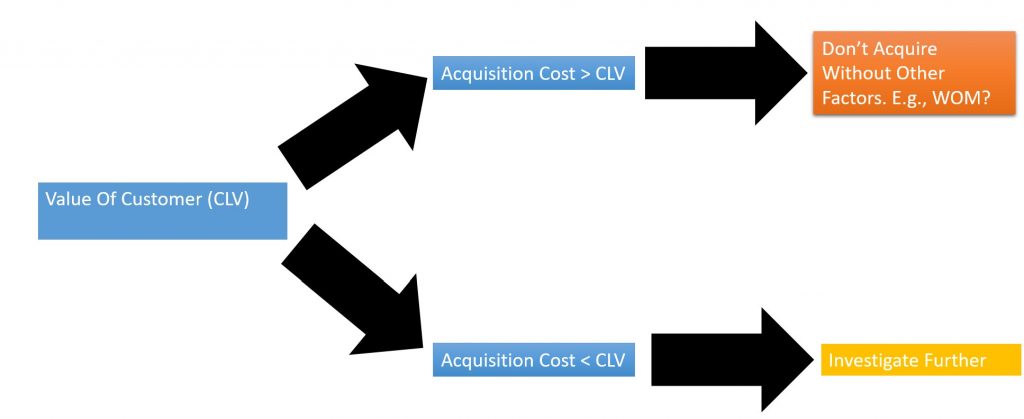

One of the most important uses for CLV is to provide a guide for acquisition. CLV gives an idea of how much you could pay to recruit a customer. Ignoring complications, such as network goods, if a customer lifetime value is projected to be $100 it doesn’t make sense to spend $101 acquiring the customer. That said, acquisition decisions are complex. As with any calculation you need to understand the details and think through what you are doing and why.

CLV And Limited Capacity: Things Are More Complex

Marketers often describe CLV as: “the amount you should be willing to pay to recruit a customer”. Unfortunately, this isn’t always true. This assumes that your ability to recruit customers constrains your success. Basically you are implying that you have unlimited capacity to serve customers. This may be true but it is not necessarily so. Imagine marketing an apartment block. Once all the apartments are full acquiring more customers isn’t worth anything. As the authors say:

..one cannot always rely on CLV to be the firm’s maximum willingness to spend (WTS) to acquire (retain) the customer relationship.

Pfeifer and Ovchinnikov, 2011.

When using any marketing calculation question your assumptions and think through what you are doing. It is not enough simply to calculate the numbers. You really must understanding why you are doing the calculation.

For more on CLV see here.

Read: Phillip E. Pfeifer and Anton Ovchinnikov 2011 A Note On Willingness To Spend And Customer Lifetime Value For Firms With Limited Capacity, Journal of Interactive Marketing, 25, Pages 178-189