A theme of mine is the challenge that marketers have with financial accounting. Essentially most marketing spending is accounted for as an expense. This is even if it has the explicit intention to be an investment. This makes financial reports pretty poor for understanding the marketing of a firm. What about Human Resources (HR). We can see something similar in what we might call Catch 22 and accounting for employees.

HR And Accounting

Ethan Rouen comes from a different perspective from marketers but has a similar concern. He worries that financial accounting rules cause problems for HR (human resources). The argument is that investments in employees are all treated as costs, not investments. This discourages such investments to the disservice of employees and society as a whole.

The reason why financial accountants do this is that firms do not control their employees. The employees can (some non-compete contracts aside) wander off and take the skills they have learned to another firm. This is not wrong but, as Ethan Rouen notes, the idea that employees are mercenaries taking training and running en masse relies upon an inaccurate view of people as homo economicus. In reality, people have connections that don’t allow for such flitting. They do feel loyalty, and training can payback. Indeed, training can promote, not destroy, employee retention. Of course, such thinking is probabilistic, some employees will leave after training but many won’t. How many will stay?

Employee Retention Concerns

Rouen dismisses concerns about using estimates of retention in the accounts given estimates already exist in the accounts.

“One concern is that measuring human capital requires vague estimates, but this argument is weak. Companies include depreciation in their financial statements, which is not only an estimate but also likely a wrong estimate given that there are different depreciation schedules for financial and tax reporting”

Rouen, 2019

A lot of the arguments covered will feel familiar to marketers. I thought Rouen was especially strong on the problems of not recording HR investments adequately.

“… because of the failure to carefully and systematically document investment in human capital, there is little evidence that these investments pay off.”

Rouen, 2019

Catch 22 And Accounting For Employees

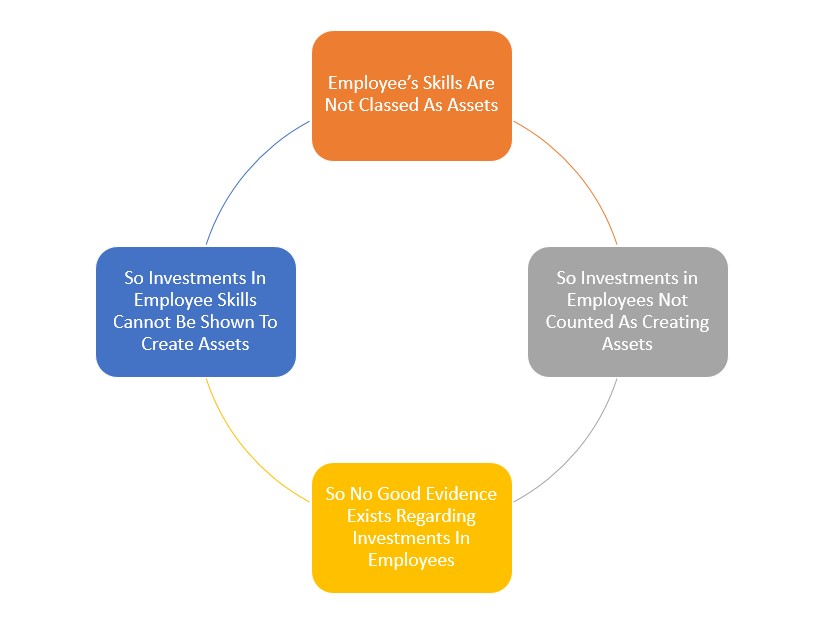

The failure to account for HR investments adequately means they can’t be demonstrated to pay off (or not). Given a lack of evidence that HR investments matter it is hard to show that not accounting for them is missing out showing how valuable the investments are. It is all very Catch 22.

For more on accounting for marketing see here, here, and here.

Read: Ethan Rouen (2019) The Problem with Accounting for Employees as Costs Instead of Assets, HBR Blog, October 17, 2019 https://hbr.org/2019/10/the-problem-with-accounting-for-employees-as-costs-instead-of-assets