Marc Fischer explains common methods of brand valuation. His work is useful in understanding brand valuation.

Different Methods Of Brand Valuation

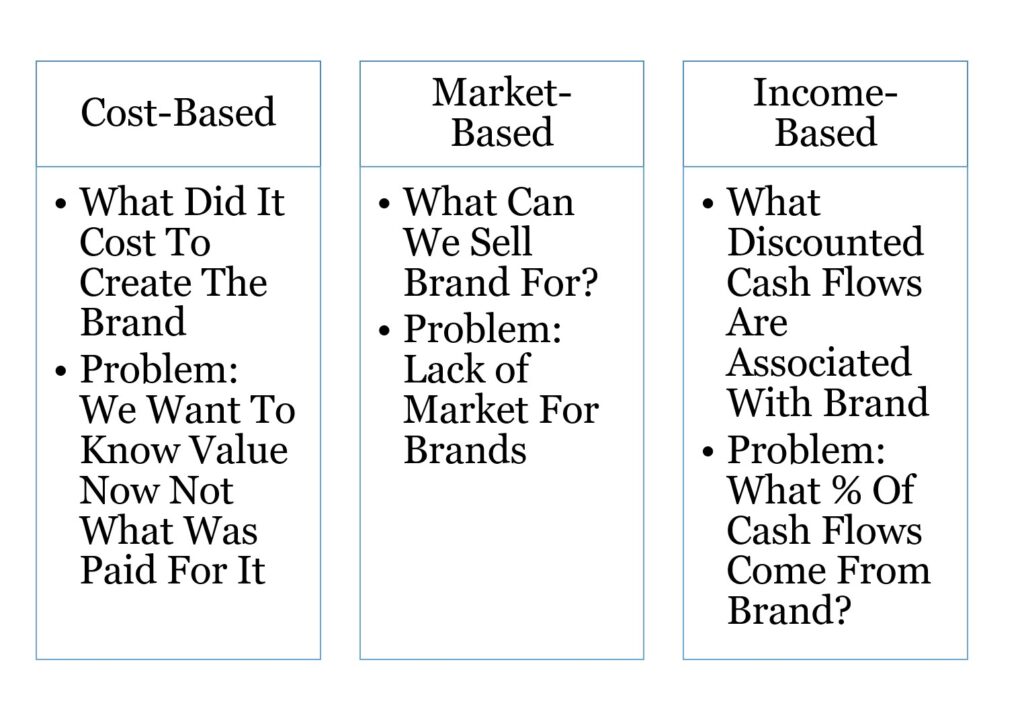

One of the problems he highlights is that there are so many methods. Different companies have their own proprietary valuation systems. He groups these into three main approaches; a cost-based approach, a market-based approach, and an income/DCF-based approach.

Cost-Based

A cost-based approach determines the value of a brand according to its inputs. When it costs more to create then the brand is more valuable.

While cost-based measures are attractive due to the objective and easy collection of data, they are heavily criticized for their theoretical weakness.

Fischer, 2016, page 187

The problem is that there is little reason to think that what it cost to create a brand is a good proxy of brand value.

Market-Based

A market-based approach suggests that what people will pay is the value of the brand.

Unfortunately, there does not exist a liquid market of brand transactions”.

Fischer, 2016, page 187

In essence, the market-based approach is theoretically better but very hard to deploy as we don’t really have many market values to use for comparison.

Income-Based

An income/DCF-based approach values a brand based upon a projected stream of cashflows that arose because of the brand. (DCF is discounted cash flow). Again this is great in theory but challenging to do in practice. Even if you can accurately project the future cash flows of a firm how do you decide what percentage of the cash flows will arise only because of the brand?

Major concerns exist about subjectivity and uncertainty.

Fischer, 2016, page 187

Understanding Brand Valuation

After outlining the problem Fischer offers his own valuation system. No system is perfect but with so many people working on valuations let us hope that they continue to improve.

For more on brand valuation see here, here, and here.

Read: Marc Fischer, 2016, Brand Valuation in Accordance with GAAP and Legal Requirements, In Accountable Marketing: Linking Marketing Actions to Financial Performance, Edited by David W. Stewart and Craig T. Gugel, Routledge, MASB