Accounting’s failure to deal with intangibles is a major problem in business. Marketers, and others, need to engage with financial accountants to find a better way.

Problems in accounting statements

Feng Gu and Baruch Lev give more details on the problems with financial accounting in their recent piece for the Financial Analysts Journal. They argue that:

Simply put, earnings no longer reliably reflect changes in corporate value and are thus an inadequate driver of investment analysis.

Gu and Lev, 2017, page 25

According to the authors, financial accounts are not much use to investors.

Financial Accounting’s Failure To Deal With Intangibles

Lev and Gu suggest that the current system of accounting was useful in accounting’s golden days. This was when the income statement was highly informative. Unfortunately, according to the authors, the world has changed — largely through much greater investment in intangible assets. In this time “..accounting regulators were–and still are–asleep at the wheel, treating the value-creating intangible investments as regular expenses”(Gu and Lev, 2017, page 25). This means that: “Consequently, corporate income statements now mix expenses and substantial investments, stripping earnings of their most valuable use: an indicator of value creation” (Gu and Lev, 2017, page 26)

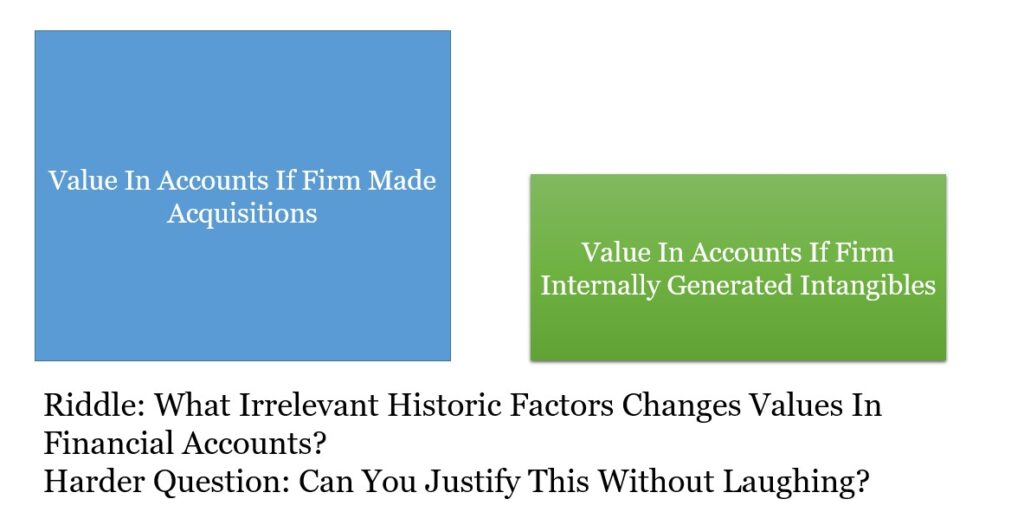

It Isn’t Even Wrong In A Consistent Manner

Financial accounting could always ignore intangibles. Spending on intangibles could always be an expense. In some ways that would be better. The resulting accounts would be easier to interpret. You would have to adjust them to something meaningful. Still, the accounts would be a clean starting point. The accounts aren’t, however, even consistent. Some intangibles are capitalized. (Accountants capitalize when they record spending as creating an asset). This happens largely when the intangibles are purchased from a third party. That some are recorded means the numbers, even though obviously biased, can’t be compared. The omissions in the accounts depend upon past, now likely irrelevant, corporate strategy. The financial accounts of firms are all wrong. Yet, each is wrong in their own unique way depending upon defunct historical factors.

What To Do?

Gu and Lev give their own way of valuing firms. They include a simple customer valuation model. (Probably a bit too simple I’d say but it is at least interesting and practical). They suggest analysts should focus on better understanding the firm’s competitive advantage. The authors give a model of strategic competitive analysis. They suggest a strategic assets inventory. This means looking at investment in strategic assets. The authors also want discussion of how the assets are protected and deployed to create value.

It is fascinating to see such views coming from respected accounting professors. What financial accountants have to do is hard. As such, I don’t want to be too negative. Yet, I can’t help but agree with Gu and Lev that there seems to be a certain complacency in financial accounting. If not too many disasters happen the current system is thought by some to be working. But avoiding disaster isn’t enough. The problem is that the statements produced aren’t necessarily useful. Without a clear use it is hard to justify the amount of time and money firms devote to financial accounting. If Gu and Lev are right, investors shouldn’t bother to use financial accounts for their investment decisions. That does cast a lot of doubt on the point of the whole enterprise.

For more on accounting for intangibles see here, here, and here

Read: Feng Gu and Baruch Lev (2017) Time To Change Your Investment Model, Financial Analysts Journal: A Publication of the CFA Institute, 73 (4) pages 23-33.