New business possibilities create conundrums for traditional systems. How will traditional methods cope? Whose problem is it when accounting is challenging?

Accounting for the Marijuana Business

Canada is in the process of legalizing marijuana (written in 2018). This has a whole host of interesting public policy implications. Still, I’m going to use this big change to illustrate a purely business issue to do with problems in accounting. Accounting relies a lot on precedent. There is some logic to this, if a thing has worked relatively well, then why change? The problem is that this doesn’t do well with new challenges.

No one really knows how big the market will be. Yet, marijuana sales are expected to be significant enough to impact the national accounts. The market potential has spawned firms eager to make money off the new business. Where there are firms there are reports. Accounting for the marijuana business throws up a whole host of problems. These illustrate problems for accounting. Simple mis-reporting by managers in various venues will cause some problems.

… Canopy Growth Corp., have reported gross margins in excess of 100 per cent.

Castaldo, 2018

This is not too surprising in a new industry. Accounting has always dealt with nonsense claims. There is a more interesting question. How should the industry be accounted for?

What Are The Assets Worth?

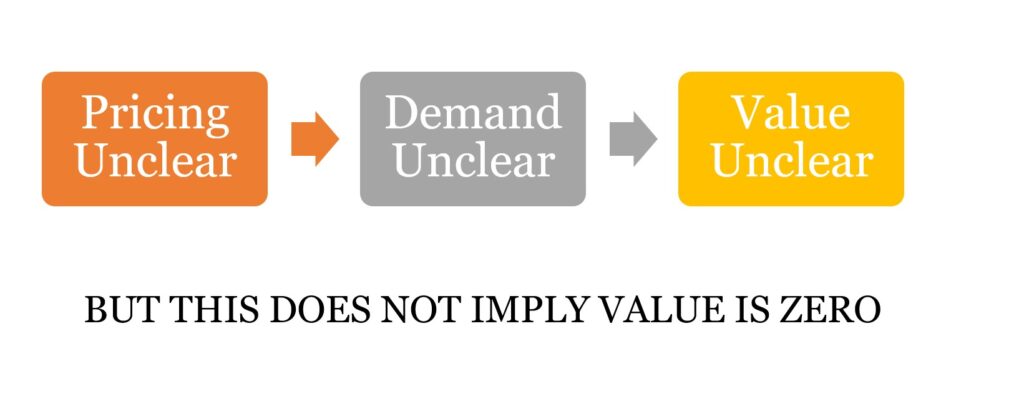

The firms that will be supplying marijuana must have significant distribution operations. These are not trivial. Operations could be the difference between a successful and an unsuccessful venture. This is extremely hard to account for. Perhaps more obviously, the firms must have a lot of the raw materials. For example, the plants. How much are these worth? To be honest no one really knows. In the article, a forensic accountant offers a favored solution. If I interpret him correctly his solution is don’t assign any value to the plants. Pricing of plants is unclear. Neither is demand clear. Therefore, the accountant says zero value. It is a bit of a rubbish solution. Still, I guess it is clear.

Whose Problem Is It When Accounting Is Challenging?

This leads me to what I think is the most interesting part of the article. The headline: “Canadian marijuana stocks have a serious accounting problem.” What struck me is that the stocks don’t really have a problem. There may well be a bubble going on. Yet, it isn’t really the stocks that have the problem. It seems to me it is the accountants’ problem (and maybe investors). To be fair, it is a tough problem.

Accountants have not been at the center of the public policy change. Therefore, it is not their fault that, take your pick, either:

- a) marijuana has been prohibited for years, or

- b) is now being legalized.

That said, the forensic accountant’s solution of just ignoring the problem and hoping it goes away doesn’t seem to be entirely satisfactory. As a result of the change, accounting has a problem and needs to engage.

If Accounting Is Useful

The most telling part of the article I believe was what the accountant said in respect of the accounting numbers.

“If investors are using the numbers at all, there’s a serious chance they’re being misled…”

Castaldo, 2018

“If” is key. Truth is that investors probably aren’t worrying too much about the accounting numbers. Although Marijuana investment is likely atypical, however, this still suggests to me that long-term accountants have the problem. We, collectively, spend an awful lot of money on external financial reporting. If even the accountants aren’t convinced that investors use the reports that is a problem.

A More General Problem

Clearly, the specific problem of marijuana stocks will fade over time. The industry will begin to provide better information. Yet, the problem of financial accounting often not being very useful seems likely to remain. Whose problem is it when accounting is challenging? I say it is accountants that have the problem. They must justify what they do. Accountants, therefore, have got to do better in confronting their challenges.

For more on challenges to accountancy see here, here, and here.

Read: Joe Castaldo (2018) Canadian marijuana stocks have a serious accounting problem, Canadian Business, January 24.