Valuing brands in accountancy has been a challenge for a long time.

The Challenge Of Valuing Brands In Accountancy

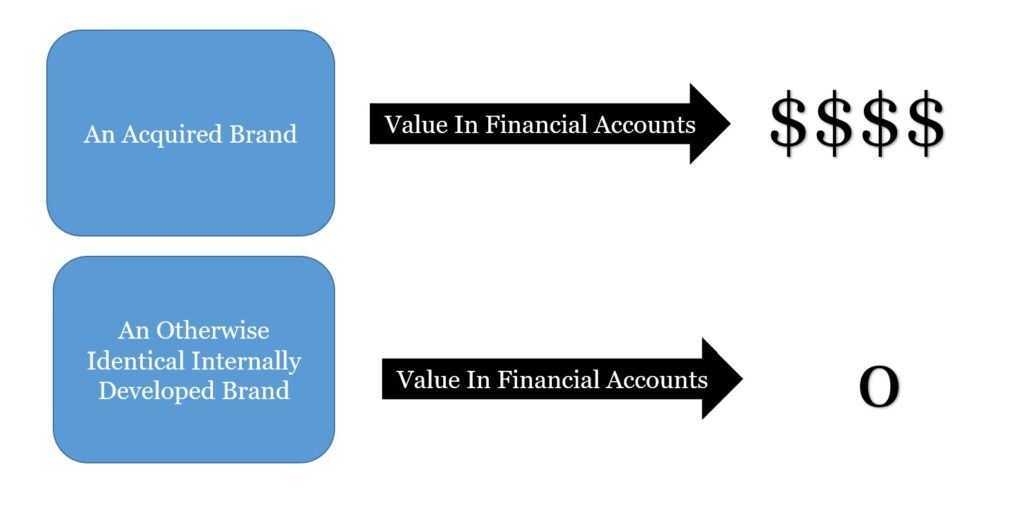

Brand valuation is a challenging topic. Still, it is a critical one for marketers. It is hard to look at corporate accounts without noticing that marketing is poorly accounted for. The accounts largely omit the value of internally generated brands. These are brands the company has developed through in-house marketing. The same accounts often include the value of purchased brands. This can cause the financial accounts to show very different values for assets that have the same financial value, e.g., the same impact on future profits.

This is the background of an article on brand valuation written by Roger Sinclair, a South African consultant and academic, and Kevin Lane Keller, a well-known academic and executive director of the Marketing Science Institute. As a marketing academic it is hard to disagree with a lot of what they point to.

By omitting the value of internally generated brands, they [financial accountants] violate their own criteria of reliability, comparability, consistency, materiality, representational faithfulness and separability.

Sinclair and Keller, 2014, page 300

What To Do?

The authors make some suggestions about getting financial standards boards to look at the problem. They clearly acknowledge the solution won’t be simple. Still, they point to the fact that the situation we are in is pretty hard to sustain. Will things change? Indeed, their tone is a little more positive about change than I might have expected. That is interesting, marketers generally will hope that the positive tone is justified.

My only quibble is that they probably won’t drive too much change with this paper. They published their argument in the Journal of Brand Management. They are somewhat preaching to the already converted. I’m assuming that not many accountants will read the journal. That is a shame as their work seems a helpful addition to the debate.

We Need To Engage Accountants

It makes me think that going forward as marketers we need to think of better ways to engage with accountants over the valuation of brands. The current system of valuing brands in accountancy is clearly not adequately capturing the contribution of marketing to business success but change will be hard. Any change will lead to increased risks for financial accountants. While the increased benefits will accrue to marketers and the business more broadly. That doesn’t necessarily make it the easiest idea to sell to financial accountants. We need more work to come up with arguments that will be compelling to accountants as well as marketers.

For more on brand valuation see here.

Read: Roger Sinclair and Kevin Lane Keller 2014, A Case For Brands As Assets: Acquired and Internally Developed, Journal of Brand Management, 21,4,286-302