How can we go about understanding intuition and does it matter?

Thinking Fast and Slow

Daniel Kahneman’s book, Thinking Fast and Slow, has undoubtedly had a significant impact on managerial thinking. In a recent piece for the ACCA (Association of Chartered Certified Accountants) Tony Grundy, an academic and consultant, discusses the perils of cognitive bias. Much of what he says is reasonable. He outlines some common problems in decision-making. For example, he discusses:

- confirmation bias. We often look for evidence that confirms rather than challenges, our preconceptions.

- the halo effect. We tend to expect good things to cluster. More attractive people are also thought to be cleverer.

- and group think. The tendency for groups to sway those with unpopular views to go along with the consensus. This leads to sensible objections not being properly examined.

Senior Managers are Human

What I do like is the way Grundy makes the point that those making major corporate decisions need to worry about the quality of their decision-making. Poor decision-making isn’t just something that junior people do. Just because you have been successful in the past (and risen through the ranks) doesn’t mean you can’t make terrible decisions now. Indeed it may be that overconfidence generated by your past successes can hurt your later decisions. As such, I think it is extremely valuable that accounting decision-makers are being advised to consider the psychology of decision making.

What is Intuition?

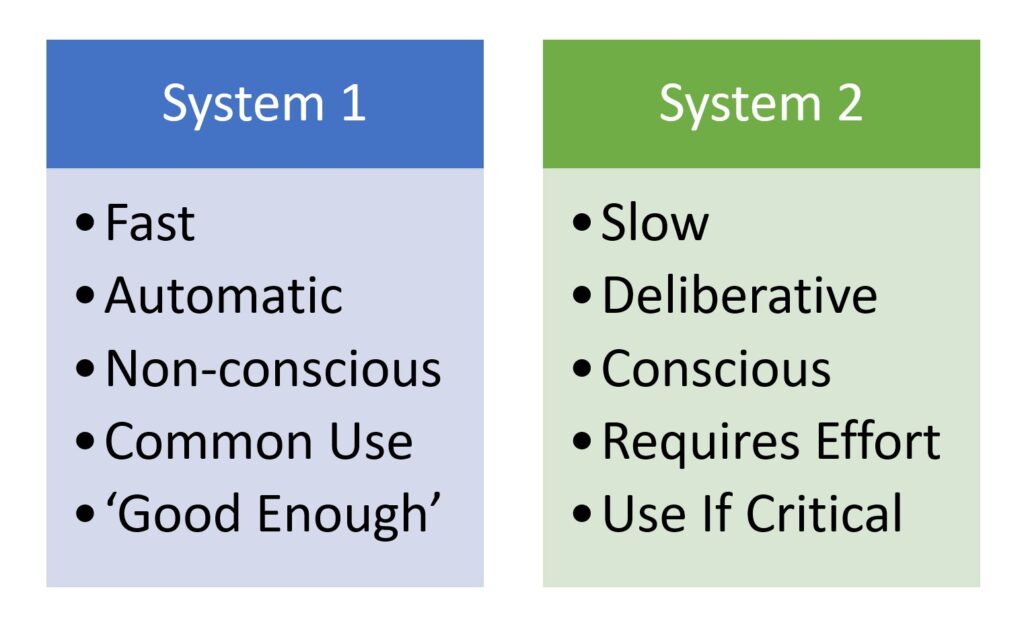

Where I do think that Grundy isn’t as clear is in respect of the nature of intuition. Too often intuition seems to be portrayed as something that is, frankly, pretty rubbish. While I have no doubt that sitting down and using slow and detailed thought is vital in business I don’t want to see intuition portrayed as something terrible. Intuition isn’t something that we need to learn to avoid. Kahneman’s System 1 (thinking fast) has certain advantages over System 2 (thinking slow). The right system to use depends upon the job to be done. I feel that there is probably some sort of golfing analogy to make at this point. Something to do with clubs. Happily, I don’t know enough about golf to do this.

Understanding Intuition

Grundy, I think, misinterprets System 1 as a largely faulty system. It is because of this he feels the need to invent a third system. According to Grundy using his third system:

you might make an intuitive leap that is not haphazard but ordered (`getting your ducks in a row`) yet seems to happen in a few blinks.

Grundy, 2017

This sounds great but it is, of course, simply describing System 1. System 1 isn’t haphazard, sometimes it makes mistakes but it doesn’t usually come up with outrageously bad, haphazard answers. We see consistently wrong answers from System 1 because it has rules that make sense. While System 1 can lead you wrong, with significant personal and social consequences, it isn’t random. System 1 is often extremely useful, especially when speed matters.

Grundy may be right to say that slow, detailed thought is often central to business success. Still, please don’t write off System 1 as simply haphazard.

For more on decision-making see here, here, and here.

Read: Tony Grundy (2017) How to avoid the cognitive bias pitfalls, ACCA, September 01, 2017