Analytical models are fascinating ways to look at what happens in markets. They can look a bit odd from the outside. These models tend to have a ton of strong assumptions which might lead to questions about their value. They can, however, help us think through some commonly observed phenomenon in markets. What then can models tell us about the impact of conformity and the need for uniqueness on markets.

Testing Analytical Models

Using the right methods we can even test Analytical models. Amaldoss and Jain (2005) establish an analytical model and then test (the simplest prediction) in an experimental economics lab. Essentially they use an approach pioneered by Vernon Smith. In this method they assume participants respond to financial incentives and induce the participants’ valuations for different outcomes. The authors give participants’ utility functions consistent with the theory. Basically it tells the participants what they want to achieve. The authors then pay participants according to how well they achieve the objectives that are assigned to them. This essentially does not test what any person does in the real-world. In the test you basically pay people to behave a certain way. That said, it does test well what happens in a market (i.e. collectively) where a bunch of people are reacting in the way specified by a theory.

Conformity And The Need For Uniqueness

Amaldoss and Jain look at conformity and need for uniqueness amongst consumers and the market effects of these. The authors set up the incentives so some participants act as snobs. These consumers value their uniqueness and are less happy as more people buy the same product as them.

Other participants are incentivized to be conformists. They are happier when other people buy the same product as them. The results make sense.

For example, “… more snobs may buy a product as the price rises. [but] only when a segment are weakly conformist.”

Amaldoss and Jain, 2005, page 31

Snobs will buy an expensive exclusive product but only when there are hoi polloi to avoid.

Sales Can Rise With Prices

The key thing they are able to demonstrate is how we might see higher price associated with more sales. This is a strange effect as we are used to seeing less sold as prices rise.

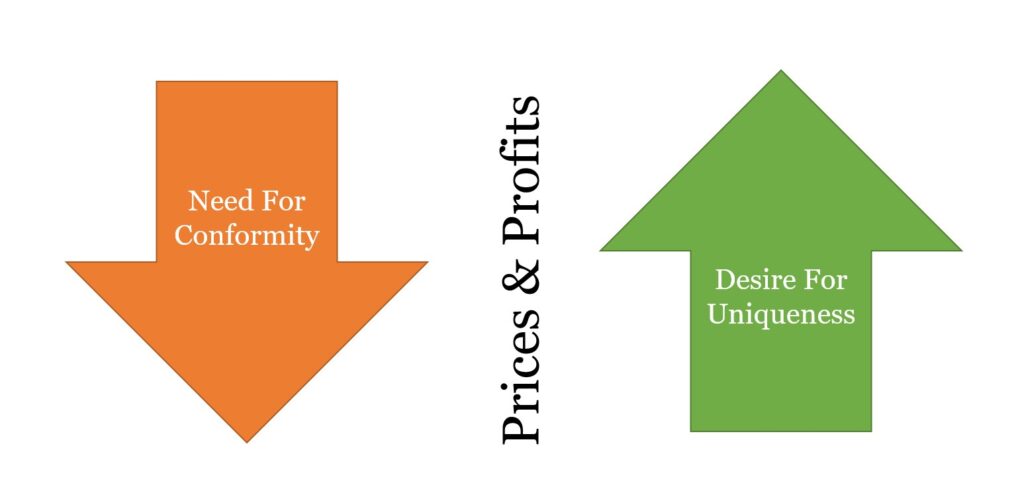

Interestingly, these behavioral effects (snobbishness and conformity) seen in consumers change the money that firms will make.

..while the desire for uniqueness leads to higher prices and firm profits, a desire for conformity leads to lower prices and profits.

Amaldoss and Jain, 2005, page 30

Understanding Markets With Experiments

It is a very imaginative approach to the problem of understanding markets. I find it interesting to see how behavioral effects play out in markets and would like to see more work like this.

For more on experiments in economics see here.

Read: Wilfred Amaldoss and Sanjay Jain. “Pricing of conspicuous goods: A competitive analysis of social effects.” Journal of Marketing Research 42.1 (2005): 30-42.