I very much enjoyed John Cassidy’s How Markets Fail. It is an ambitious piece in which he tries to describe how economic thought has impacted real-world markets. He has a special focus on the collapse of the financial markets in 2007/8 and the economic thought behind the failure to regulate the markets properly. What does he say about the failure of markets?

Utopian Economics

He outlines many of the problems that he sees with conventional economic theory, which he calls “Utopian economics”. He contrasts the Utopian approach with what he describes as “reality-based” economics. This reality-based form includes behavioral economics. But it goes much wider than this. Reality-based economics includes considering tricky issues around the institutional details of markets. We shouldn’t just examine demand and supply. Instead, we should consider how the buyers and sellers can actually get together to form the market.

I appreciated Cassidy’s viewpoint on market details. This is despite the fact that I think theory is important too. I wouldn’t want to see reality-based economics as atheoretical. I see the problem with the Utopian based economic models not as their use of theory. Instead, it is a problem of assumptions. If you assume people will behave in a certain way despite the fact that they never behave that way, then it isn’t really surprising if your predictions are poor. This will happen even if your theoretical model is internally consistent and its math beautiful.

Accurate Assumptions

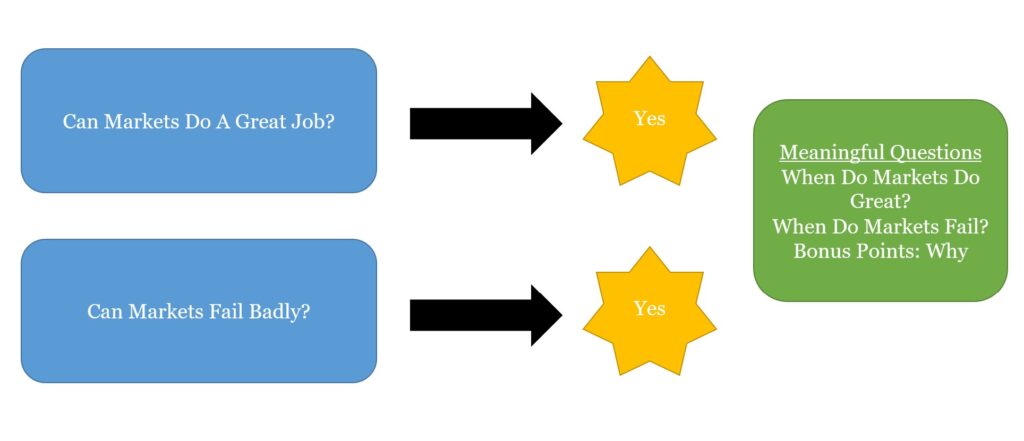

Seeing the need for reality-based economics, especially the need for accurate assumptions about people and institutional details, allows one to consider some key questions about the simplistic views of markets we often see. That markets can work marvelously is not a guarantee that markets will always work perfectly. This is not even a guarantee that markets will work better than any given alternative.

In healthcare, there are many challenges with single-payer systems. Still, it is important to understand that advocating for “free” markets often doesn’t solve these problems. Indeed, it often creates new issues. (Got to say US healthcare is a bit of a nightmare. Even for me and I can afford to pay). As such, the key question isn’t “do markets in general work or fail?”. That is too crude. Instead, we want to know “in what circumstances do markets work or fail?” We need to figure this out to better understand whether markets are likely to fail or not in specific circumstances. We then can set public policy informed by reasonable assumptions.

The Failure Of Markets

Clearly, this is a massive task. Yet, a dose of reality-based thinking as Cassidy advocates seems necessary to avoid simply repeating past mistakes.

For more on understanding markets see here, here, and here.

Read: John Cassidy (2010) How Markets Fail: The Logic of Economic Calamities, Picador