Ex-Ivey PHD student and now University of Calgary professor, Charan Bagga, and I have just published an article. This focused on the teaching of CLV (Customer Lifetime Value). We surveyed the state of case-based teaching materials related to CLV and found them a pretty shoddy bunch. Teaching CLV badly seems to be the default way to teach CLV.

CLV Without Any Managerial Application

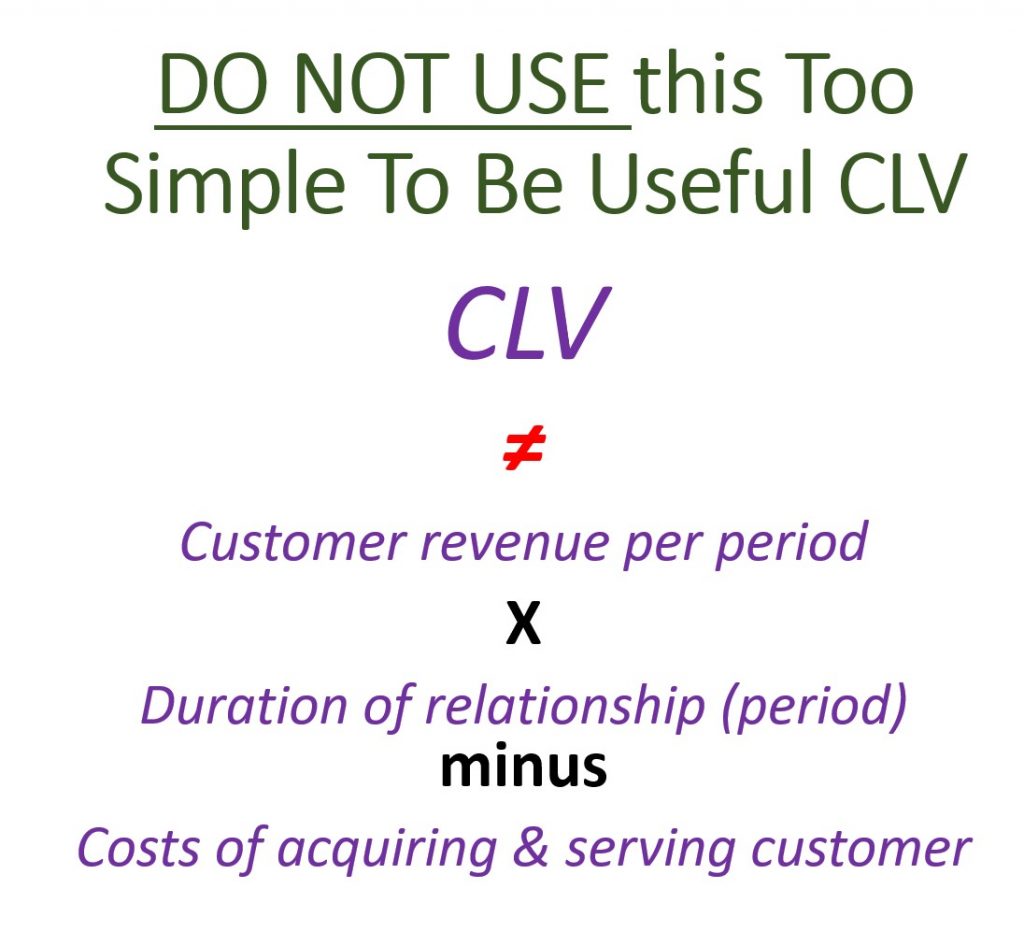

One problem is that many of the cases calculated CLV in a way which had no obvious managerial application. If you want to decide how much to spend on acquiring customers, you really must discount any cash you’ll receive in the future. Doing so allows you to properly compare it to any cash that needs to be invested now. Similarly you can’t use CLV to decide how much to spend on acquiring a customer if you subtract the acquisition cost before reporting CLV. This is because CLV is already net of acquisition costs.

Teaching CLV Badly: Confusion Abounds

We examined 33 cases and related materials.

[These] show considerable confusion in teaching materials; they contain incorrect formula, erroneous claims, and contradict other materials from the same school.

Bendle and Bagga, 2016, page 1.

Teaching CLV Better

Perhaps most importantly we have some pretty clear recommendations.

[We] recommend educators always (a) use contribution margin, (b) discount cash flows, and (c) never subtract acquisition costs before reporting CLV. .

Bendle and Bagga, 2016, page 1

The teaching of CLV is currently pretty awful. Still the good news is that it should be relatively easy to improve by following some pretty basic advice. It really isn’t hard to do a much better job.

For more on CLV see here. Many of the materials you need to teach CLV better are there.

Read: Neil Bendle and Charan Bagga, (2016), The Confusion About CLV In Case-Based Teaching Materials, Marketing Education Review, This link might work if you want to see the full paper: The Confusion About CLV in Case-Based Teaching Materials