Keith Ward in his great book Marketing Finance addressees success factors in managing at the marketing finance interface.

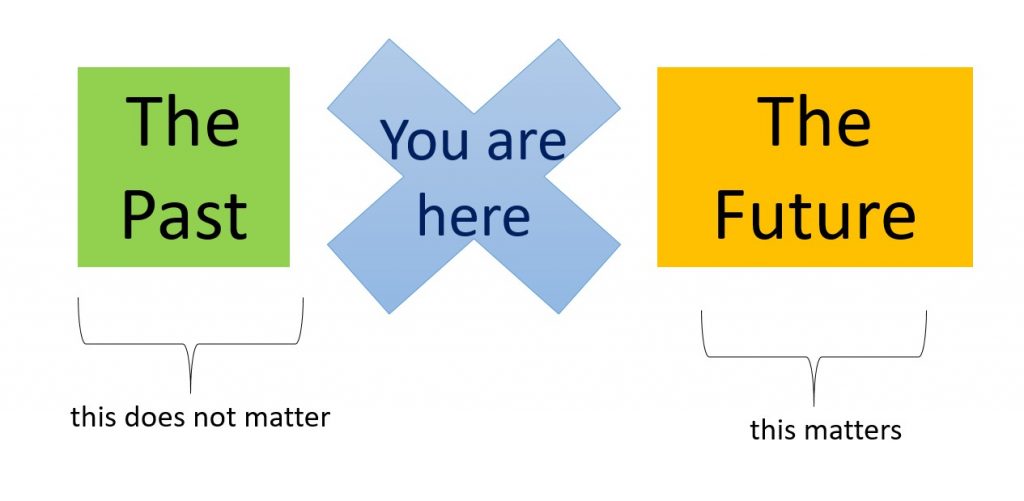

The Future Is What Matters

Ward starts by noting that historical analysis can’t change the past. Okay, that is pretty obvious. The implication is important, however. Historical analysis is mostly only useful if it “can be applied to make the future better” (Ward, 2004, page 293). This point seems often to be lost on many analysts. One can look at an analysis and admire it as a thing of beauty. Still one isn’t sure what happens next.

“Unfortunately many management accounting processes overemphasize the purely historical reconciliation aspect of reporting”

Ward, 2004, page 293.

It isn’t enough to find out what happened. To be useful analysis should change something going forward. As such “Marketing finance must be totally involved in both planning and controlling marketing activities” (Ward, 2004, page 293). I fully agree.

Managing At The Marketing Finance Interface

Later Ward turns to his advice for moving towards more successful management at the marketing finance interface. He has ten critical success factors. Ten is a bit of a magic number. (I always worry someone got to nice bits of advice and padded it to ten). Still there is some great advice. I’ll just highlight three that especially resonated with my thoughts.

Critical Success Factor (2): “The marketing finance system must communicate the necessary information to the marketing managers making these key strategic decisions” (Ward, 2004, page 305). The implication is don’t let accountants decide the format. (To be clear I’m not blaming accountants. Marketers often ignore the accounting information. Rather than supplying the sort of feedback the accountant needs to improve it they pretend it isn’t happening. You can’t really complain that the output isn’t useful if you don’t give advice on how to improve it).

Critical Success Factor (4): “Focus on, and measure, the intangible marketing assets of the business” (Ward, 2004, page 306). The key point is that brands and other marketing assets are major assets. If you don’t know much about them you don’t know much about your business.

Critical Success Factor (6): “True financial control can only be exercised in advance of financial commitment” (Ward, 2004, page 206). When creating effective financial records one need to understand commitments as they are being made. A decision support system can’t simnple capture when the invoice comes through. Effective record keeping can do this — but it isn’t always easy.

Want To Know More?

My blog has a lot of work on marketing accountability and challenges with the managerial and financial accounting of Marketing. See here, here and here or just search the site. For more on how I think we could better record marketing see here.

Read: Keith Ward (2004) Marketing Finance: Turning Marketing Strategies Into Shareholder Value, Elsevier