Let me start this post by saying that I have had good experiences with Qualtrics. I have used their survey panel services before, and would certainly do so again. (Assuming they want me as a customer after this blog post). Unfortunately their attempt to give advice on CLV is, let me use a technical British English term, completely rubbish. There is something about CLV that encourages people to do an appalling job. I approve of companies like Qualtrics helping to popularize marketing metrics but the advice they share is worse than useless. Too simple CLV measures are worse than no measures at all.

What Does CLV Help With?

According to Qualtrics knowing CLV helps businesses develop strategies to acquire new customers and retain existing ones. That sounds promising so I dug into the details and something less promising happened. They start with the phrase “Ultimately, you don’t need to get bogged down in complex calculations” (Qualtrics, n.d.). In one sense this is true, getting bogged down is rarely helpful but you can’t simplify to the point where the result is meaningless. Doing no calculations is always the simplest option if you really don’t want to get bogged down in detail.

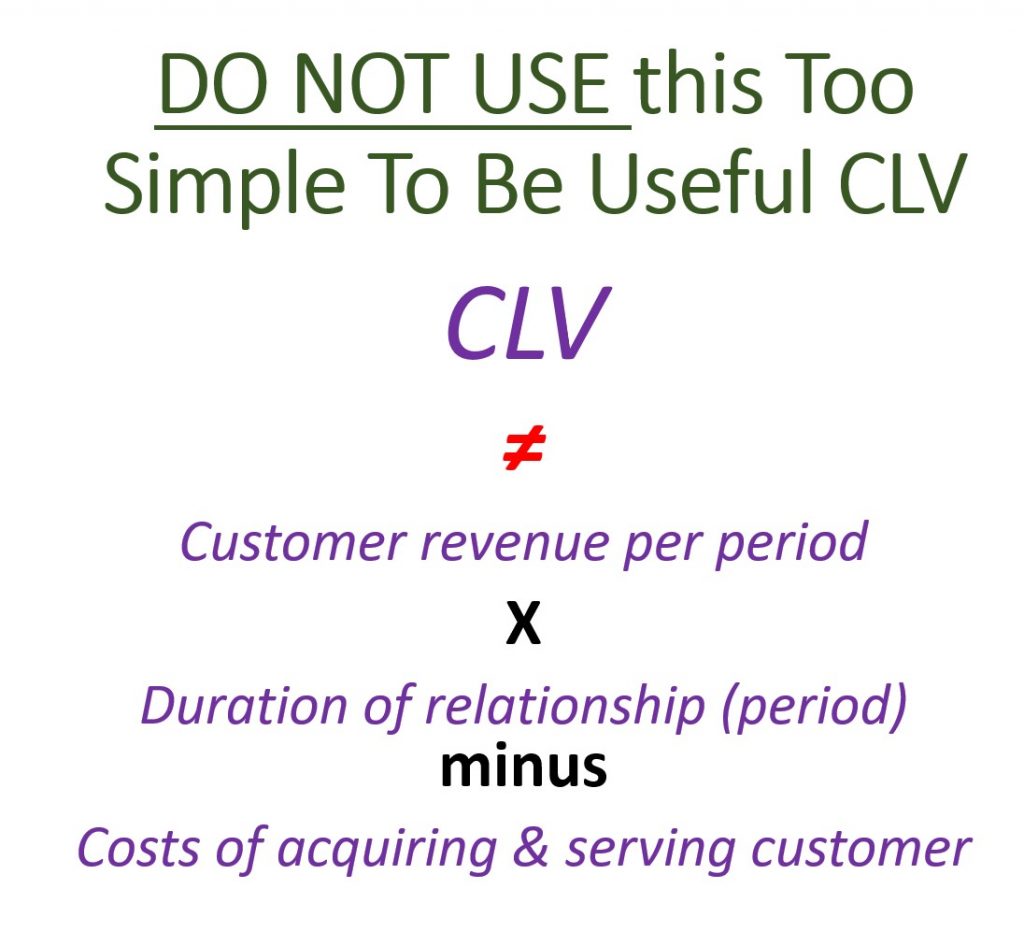

They give a simple formula that is Customer Revenue Per Year times Relationship Duration minus Acquisition Costs. It is hard to know where to start, given this formula is so poor. It is a too simple CLV measure. DO NOT USE IT.

Too Simple CLV Still Adds Unnnecesary Complication

Ironically despite being a too simple CLV it adds an unnecessary complication. It subtracts Acquisition Costs from CLV so the simple formula adds a complexity that is unnecessary and counterproductive losing even the benefit of simplicity. This does not measure how valuable the customer is, which is what they claim their metric does. I’m not sure what you would do with the number they recommend calculating.

Use Retention Rate To Spot Attrition

A header promised to tackle “Why is customer lifetime value important to your business?” (Qualtrics, nd). They suggest that CLV is good for spotting attrition but I don’t know why you just wouldn’t look at the retention rates and not bother with any lifetime value metric to track attrition. (Of course, to make things worse the too simple CLV they introduced doesn’t even use retention rates).

They Then Lose Acquisition Costs

After a couple of false starts with formulas they share a ‘traditional CLV Formula’. This is so much better but there is no explanation of why acquisition costs no longer features in CLV. (To be clear acquisition costs never should feature in CLV but if you think these costs should be there at least be consistent in your mistakes). Also they now use margin rather than revenue in the formula. (To be fair there was a mention of cost to serve earlier but no mention of other costs).

Margin is correct, revenue is not, but again not a mention of why this massive change has happened. It seems with their advice you can pick any formula you like, describe it the same way, and let the viewer guess what you mean.

Marketers Must Care About The Numbers

This shows a cavalier lack of attention to the numbers. Marketers must be better than this or their colleagues in other disciplines will laugh at them. Saying you don’t want to get bogged down in details doesn’t mean you can do whatever you want.

For more on CLV see here.

Read: Qualtrics (n.d.) What is customer lifetime value (CLV) and how do you measure it? https://www.qualtrics.com/experience-management/customer/customer-lifetime-value/