Haskel and Westlake in their excellent book “Capitalism without Capital” point out the problems that record keeping has with recording assets. (My last comment on this book I promise). There is a big problem in respect of public policy and intangibles.

Reporting Challenges

They note the asymmetry of the rules around intangible reporting. Namely that intangibles are reported in certain situations but not others. This is done even though such reporting is thought to be too hard to do properly. This is something I have noted before. Still the seemingly erratic reporting makes it hard to see the impact of various assets on the national economy. If policy makers don’t see the importance of intangibles in the public records then policy makers are unlikely to give them sufficient attention. The policy markers are unlikely to see the implications of an intangible heavy economy, as Haskel and Westlake would like them to. Nor are the policy markers likely to improve public policy in respect of intangibles.

Changes To The Equity Base (And ROE)

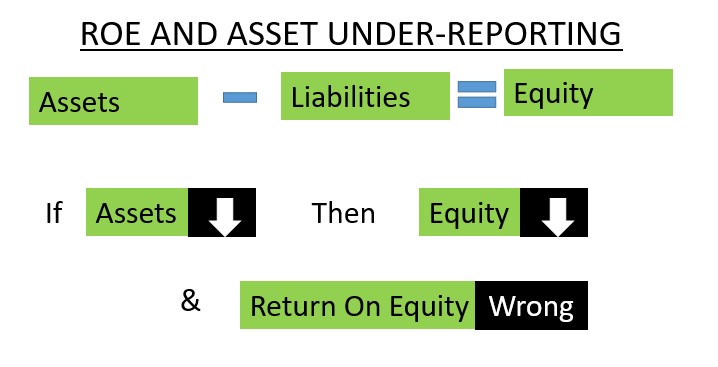

The authors note the problem of reporting ROE (Return on Equity). I have often thought about this. Many of the metrics we use are very misleading. The metrics simple do not really tell us what they claim to reveal. Not accounting properly for assets leads to the misstatement of equity. When equity is misstated then return on equity isn’t really a meaningful measure. Metrics give the wrong results when their inputs are wrong.

The authors go beyond the simple measurement problems. They suggest that intangibles actually create the need for different funding of firms. Maybe firms should have less debt and more equity. This will help them better cope with the uncertainties of the intangible economy. This seems like an interesting idea.

What Are The Public Policy Implications?

Haskel and Westlake outline a bunch of policy proposals. Many of which are very interesting. Some may be a bit speculative. (But I have no problem with that. They don’t know the future and, like any of us, can only give it their best guess). They do suggest that greater funding goes into education. I happen to agree with them. I think the logic they outline makes sense. Still I suspect as an academic I was never the sort of person they would have a problem convincing of this.

****

The world is a different place from that envisaged when reporting systems where set up. This is partly due to the importance of intangibles to many modern economies. The implication is that: “Financial investors who can understand the complexity of intangible-rich firms will also do well” (Haskel and Westlake, 2017, page 206). This seems like a compelling call to train financial people in marketing. Let us all invest more in marketing (and other) education.

For more on intangible assets see here, here and here.

Read: Jonathan Haskel & Stian Westlake (2017) Capitalism without Capital: The Rise of the Intangible Economy, Princeton University Press