Some have begun to make the argument that there is a technological revolution. A move towards intangible assets. How does one go about measuring a technological revolution?

A Problem With Accounting

Corrado and Hulten highlight a major problem in the way accounts are created. This applies to both corporate and national accounts. A basic idea underlying many sets of accounts is to measure things at a given point, “stocks”. When you do this at two periods changes over time show you “flows”. All else equal, any positive difference over time between the assets owned is progress in any given period.

The challenge the authors point to is that:

..companies are moving away from the making of things in the United States and focusing increasingly on services or product development, design, and marketing.

Corrado and Hulten, 2010, page 99

National and firm accounts are relatively better at monitoring tangibles. Tangibles have physical substance. They are products. In essence, accounting is pretty good at measuring the making of tangible things. Unfortunately, the accounts are not as good at measuring challenging things like marketing assets. They are ideas, systems, associations etc… The accounts often omit them. Because of this we have a big problem. What is owned at any given point, i.e. wealth, is not captured by the accounts. This means that they can’t be great at measuring changes in wealth.

It Is Not Just Marketing

I often describe issues relating to marketing. Much of what Corrado and Hulten focus on wouldn’t typically be classified as marketing. Innovation is a major part of the modern economy. The national accounts don’t do a good job of capturing that. Research and Development is very tricky to account for in national (or firm) accounts. There is a clear bias towards accounting for “development” activity. This is activity close to creating a finished product. Equally crucial is “research” that produces early-stage ideas. Accountants generally ignore early-stage research. As a result, it has no value in the accounts.

The authors look at what makes for savings and capital investment. They define savings.

…when resources are used to provide future rather than current consumption, and from the producer’s standpoint, investment is the commitment of current resources to gain future profits.

Corrado and Hulten, 2010, page 100

Of course, investment is precisely what firms do when they invest in long-term marketing strategies. It is also when devoting resources to innovation etc… Our accounting systems just aren’t reporting what they are supposed to report. (To be fair I’m not suggesting that this is easy to do).

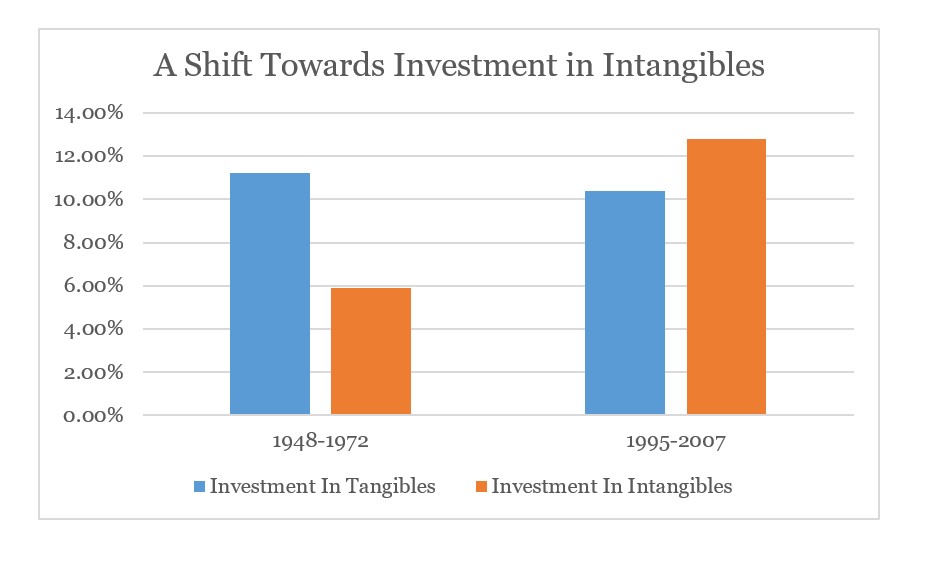

Measuring A Technological Revolution: Trends In Intangible Investment

Corrado and Hulten look at changes in the types of investment over time. They calculate the percentage of gross business output invested in tangible or intangible assets. Their figures show a modest decline in tangible investment, This was from 11.2% to 10.4% between 1948-1972 and 1995-2007. For the intangibles, the story is very different. The investment rate in intangibles more than doubles. This was from 5.9% to 12.8%. Intangible investment is now the biggest game in town.

Producing accounts (national or firm) is always going to be challenging. Yet, intangibles aren’t some sort of strange exception. One cannot just ignore them and hope no one notices. Corrado and Hulten point to a technological revolution. This is a major change in business practice. No change in recording systems, therefore, will leave the accounts increasingly at risk. They are looking increasing divorced from reality. Change can be a good thing.

For more on accounting for intangibles see here, here, and here.

Read: Carol A. Corrado and Charles R. Hulten (2010) Measuring Intangible Capital; How Do You Measure a “Technological Revolution”?, American Economic Review: Papers & Proceedings 100 (May) pages 99-104.