My second delve into Richard Thaler’s Misbehaving concerns managerial decision making. How managers decide is a massively important topic.

Equilibrium Conditions Don’t Describe Any Point In Time

Economic models often study equilibrium conditions. These apply where no manager will want to change their decision. Given they model this some academics seem to think that this describes reality. One can argue whether this is a reasonable assumption in economics where they often focus on aggregation and the long term. It, however, seems just strange in a business school. The students and managers we see clearly aren’t perfect decision-makers. (This isn’t a criticism. In my view real human beings are much more interesting creatures than the weird creatures invented for the benefit of economic theory).

Business schools make a lot of money from teaching executives to be better decision-makers. This market would not exist if they already were perfect decision-makers. A cynic about business schools might argue that the courses don’t do managers any good. Yet, even this argument is self-defeating in this context. Even if you believe that courses are useless the fact that managers pay to take useless courses proves they aren’t perfect decision-makers.

How Managers Decided At GM

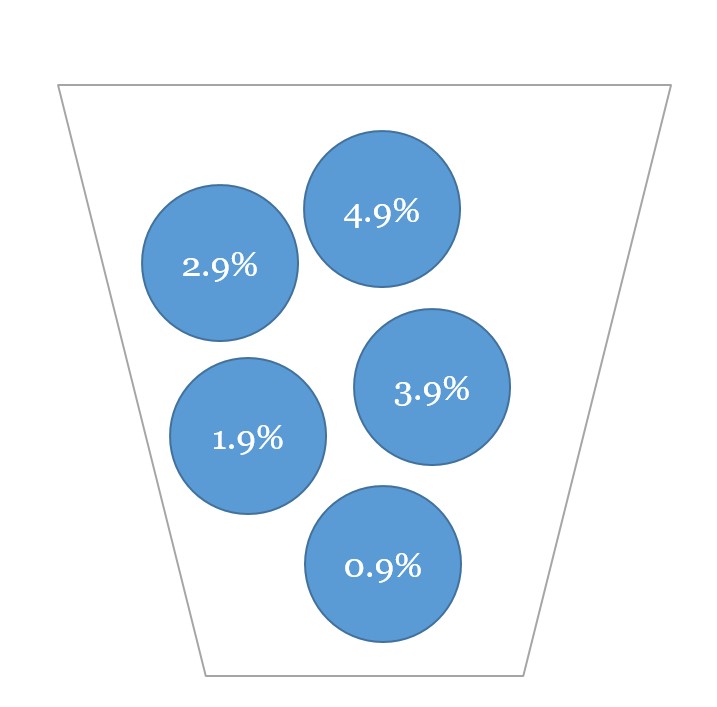

It was thus with interest that I read about Thaler’s experiences at GM. The firm had a big decision about what APR to charge on a promotion designed to get rid of excess inventory. A number of suggestions were made but how did they decide?

Finally, someone suggested 2.9% and Roger [Smith the CEO] decided he liked the sound of that number.

Thaler, 2015, page 123

Of course, some managerial decisions are informed by analysis. Yet, I think we are misunderstanding the way the world works if we don’t recognize this sort of hunch-based decision-making happens more than we pretend it does. Managers’ hunches use lessons from experience. As such, they are far from arbitrary but they aren’t the complex optimizations of economic and business theory.

The promotion seemed to work pretty well but would 4.9% or 1.9% have been even better? We’ll never know. Thaler suggested that GM run some tests to see. They decided against testing suggesting instead they would perfect inventory planning next year. This would mean they would not need to run promotions in future. Of course, they didn’t improve inventory planning.

How Managers Decide

A huge company had spent millions of dollars on a promotion and did not bother to figure out how and why it worked.

Thaler, 2015, page 123

I’m pretty sure the decisions of these managers weren’t all perfect.

For more by Richard Thaler see here, here, and here.

Read: Richard Thaler(2105) Misbehaving: The Making of Behavioral Economics, WW Norton.