Fred Reichheld is best known for his (over) exuberant advocacy of the Net Promoter Score. Introducing Net Promoter he suggests a difference between good and bad profits; an interesting, though theoretically imprecise, idea.

Are All Dollars In The Same?

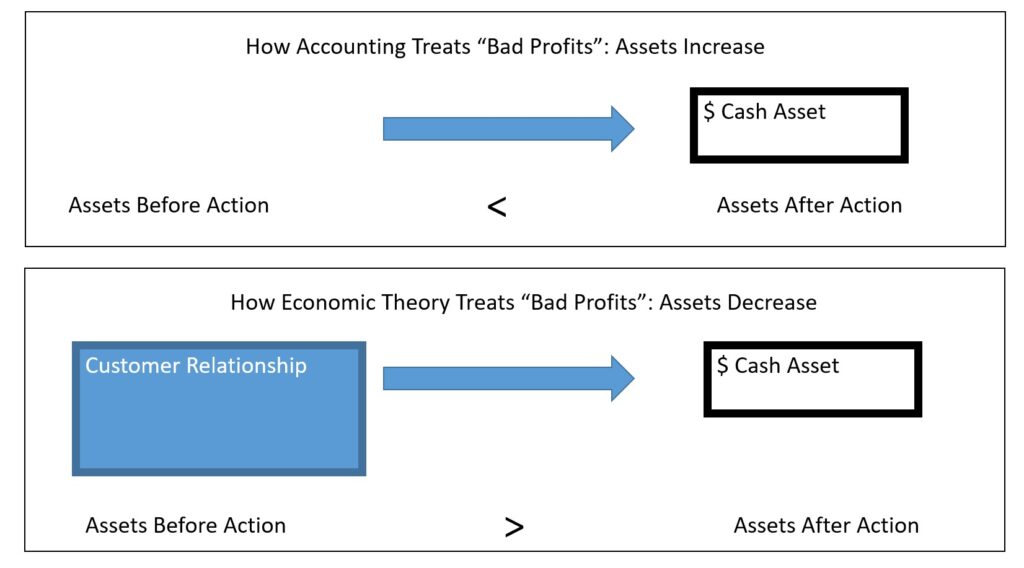

Short of outright fraud, isn’t one dollar of earnings as good as another? Certainly, accountants can’t tell the difference between good and bad profits. All those dollars look the same on the income statement.

While bad profits don’t show up on the books they are easy to recognize. They’re profits earned at the expense of customer relationships.

Reichheld and Markey, 2011, page 25

In Reichheld’s thinking, good profits are those that marketers like to discuss. They are earned following the marketing concept — giving customers products they value. He recommends pursuing these as a goal.

Good And Bad Profits

Reichheld distinguishes these from bad profits. Here he means fees that irritate consumers, and fines that punish minor consumer infractions. (Think of your cell phone provider). This is a useful debate to have. Unfortunately “bad profits” is poorly defined. There are two things it could cover.

Firstly, annoying fees that customers swallow because the market is uncompetitive. Some irritating fees probably benefit companies. The customers may hate them but what option does the customer have but to pay up? This sets up an interesting discussion over the marketing concept. What if irritating your customers is profit-maximizing because, after all, you have them trapped?

I think that Reichheld mostly means something else by bad profits. You annoy customers so much with petty fees that, in the long-run, you lose money. Basically, you collect cash off your customers now at the expense of the long-run relationship. The theoretical problem with this conception is that these bad things aren’t really profits.

Customers As Assets

The customer relationship can be seen as an asset. By irritating customers you are destroying this for a short-term cash infusion. In economic, rather than accounting, terms, you are just depleting your assets not making a profit. (It is conceptually the same as selling factory machines for less than they are worth. You do generate immediate cash but incur a long-term loss.) The only reason to call these profits is because of financial accounting rules which (for reasons that aren’t totally crazy) don’t recognize marketing assets.

A marketer’s job is to value customer assets. Reichheld highlights this which is very useful. Basically, I think the message is a useful and probably easy to communicate one so I’m not criticizing. (They really seem very good at messaging which I respect). Still, I think the idea omits a key point. Recognizing that these bad outcomes aren’t profits at all if they merely destroy customer relationships I think is necessary to convincingly argue against bad profits.

For more on NPS see here. For more on customer equity which is related to the idea of customer assets see here.

Read: Fred Reichheld and Rob Markey, The Ultimate Question 2.0: How Net Promoter Companies Thrive In A Customer-Driven World, 2011, Harvard Business Review Press, Boston, MA