For the next few weeks I’ll discuss Lev and Gu’s new book on the problems of financial accounting, The End of Accounting. Here the authors discuss financial information and stock prices. Basically, the relevance of accounting information to investment decisions.

Financial Information And Stock Prices: Little Connection

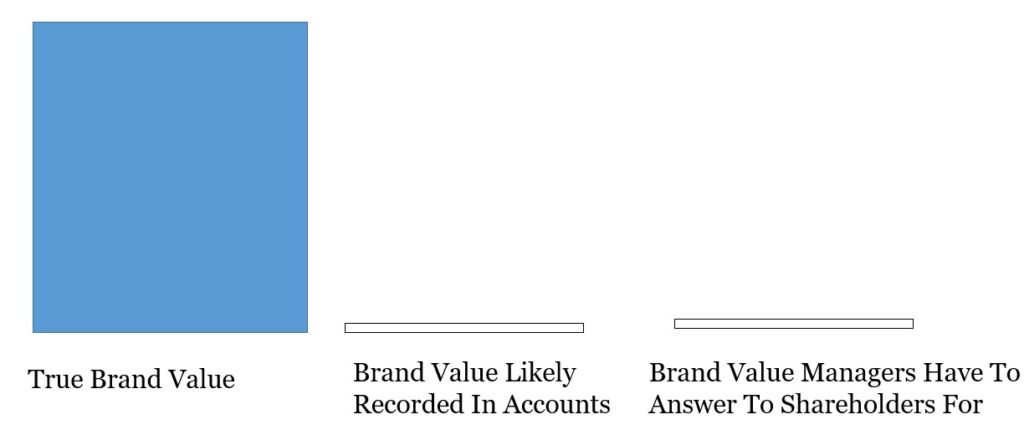

This book sets out the case that financial accounting reports are getting increasingly divorced from usefulness to investors. The authors argue that the accounts miss too much of value. Financial accounts simply do not capture what makes a firm valuable.

Counter-intuitively Lev and Gu also suggest that, despite the accounts not capturing important things, there are also too many estimates hidden in the accounting values. They are fans of disclosures and commentary rather than estimates.

Earnings And Book Value

One particularly useful task they take on is documenting the discrepancy between the market value of firms and the information captured in company financial accounts. They examine two types of accounting information in detail.

- a) the firm value in the accounts (known as book value) and,

- b) earnings.

They use regression to see how useful book value is at predicting the market value of U.S. public companies. It used to be decent in the 1950s but the usefulness at predicting market value has declined precipitously since then. A similar story is told when one looks at the usefulness of reported earnings in predicting market value.

Come to think of it, this is not totally surprising. By the structure of accounting procedures, what affects the income statement also affects the balance sheet, and vice versa.

Lev and Gu, 2016, page 35

Put simply if you don’t record assets effectively on the balance sheet this will cause you to charge the wrong amount to the profit and loss and the earnings will also be off.

Lev and Gu do a great job of motivating the problem in financial accounting.

For more on the work of Baruch Lev see here, here, and here.

Read: Baruch Lev and Feng Gu (2016) The End of Accounting: and the Path Forward for Investors and Managers, Wiley