Advocates for more behavioural approaches to understanding economics often use experiments. These typically show people acting in strange ways. Or at least that violate the principles of traditional economics. (Maybe the people are normal and the principles weird). A key thing is that experimenters and economists can be the same people. There is much potential uniting these approaches.

Hostility To Experiments

Larry Samuelson explains some hostility to experiments.

The assertion is made that poorly motivated undergraduates in the artificial and unfamiliar situations often found in experiments are not reliable indicators of how people actually behave when making important economic decisions.

Samuelson, 1997, page 140

Thus, those of a more traditional bent dismiss experiments. They say they are not generalizable to the real world. The argument is that short-run games don’t tell us much about long-run behavior.

As experience with a game is accumulated, a player’s behavior is likely to adapt… players begin to learn.

Samuelson, 1997, page 91

Short-term experiments don’t capture learning well. One can do longer experiments but they are hard and expensive. So they aren’t done much.

The Ultimatum Game

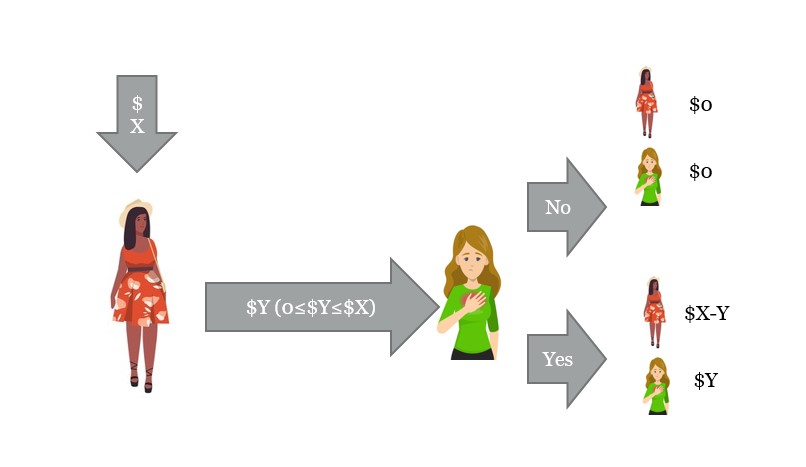

Many experiments are performed now with real money. These can reveal people’s preferences. In the Ultimatum Game, player 1 makes an offer to player 2. The offer is of a portion from a joint pot. Player 2 can accept the offer. If so, this is great. If not, everyone loses everything.

The good thing about traditional economic theory is that it has a clear prediction. Player 2 will always accept any offer above zero. After all, 1 cent is better than nothing. Knowing this player 1 will offer the minimum possible. What ‘should’ happen is very clear.

Of course, this isn’t what happens. Ask people around the world and they don’t do what they ‘should’.

In the case of the Ultimatum Game, the relevant experiments have been replicated too often for doubts about the data to persist.

Samuelson, 1997, page 140

Many people simply don’t behave the way traditional economic theory suggests they should. The theory is good in the sense of clear. But really bad in the sense of predicting behavior.

Experimenters And Economists

We can, and should, test theory. Of course, we should not simply assume that all experimental results generalize. That said, to assume that well-conducted experimental studies have nothing to tell us also seems hard to defend. We know most people don’t offer the minimum they can. I would like to see more work thinking about what behaviors found in experiments might persist in markets and which won’t. Samuelson’s math-heavy evolutionary models, thus, give potential ways to unite experiments with traditional economic theory. One can see whether giving more is a better approach. If 1 cent will not be enough it makes sense to offer more. Even a selfish person would offer more if it was better to do so.

In Samuelson’s analysis, I think it might be helpful to clarify one difference. That is between the subjects learning to change their behavior and market selection weeding out failing subjects. Despite this quibble, I think his is an interesting approach. I can help us understand what behaviors might persist in markets. What experimental findings are likely to apply in markets. And which are simply quirky.

For more on markets see here, here, and here.

Read: Larry Samuelson (1997), Evolutionary Games and Equilibrium Selection, The MIT Press, Cambridge, MA.