Sometimes I worry that marketing academics have a bit of an inferiority complex. We seem to have an aversion to anything developed in marketing. Instead, we look back to psychology (if we are consumer behavior scholars). Or we look to economics (for more quantitative scholars). This means that we often see citations to other disciplines with little else to justify the choice for a marketing question. The message is: ‘this comes from, say, economics so it must be good’. Yet, this doesn’t make sense. The right metric depends upon its planned use.

Nobel Prize Winner’s Name Means Good For Any Use

I get the impression this has happened a bit with “Tobin’s q”. If you can cite a Nobel prize winner economist, James Tobin, that seems to answer any questions and show that what you are doing is good.

With the use of the (Accounting-based Approximations of) Tobin’s q metric you may also see citations to finance papers. The marketers’ logic seems obvious.

- Finance papers often have high standards.

- A metric is used in a finance paper.

- Therefore, the metric must be good for any purpose.

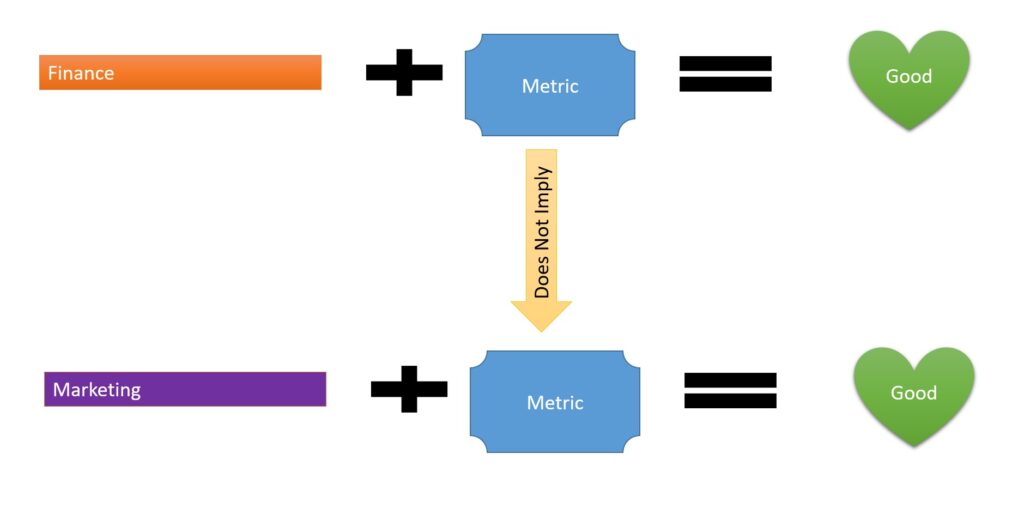

The problem is that this logic is wrong. I’m not saying that there are flaws in finance papers. (Or at least more flaws than in any other discipline). The point I’m making is that even if a metric works in finance it doesn’t necessarily work in marketing.

Biases Arise Depending Upon What You Use A Metric For

The specific problem in using Tobin’s q as a performance metric in marketing is that there are biases in the metrics introduced by the use of book value. These biases are specific to marketing. This is because marketing assets are especially vulnerable to being ignored by accountants. The implication is that Tobin’s q metrics that use accounting data are higher for firms that do a lot of marketing. The bias is simple. Marketing investments look more effective when the performance metric is Tobin’s q.

What does this mean? If you are studying something completely unrelated to marketing then maybe not too much. There will be errors. Still, if errors are unconnected to your research question this might not be a big deal. Yet, if you are studying whether marketing is effective the bias is self-evidently problematic.

A metric’s suitability depends upon the question being addressed (Ambler and Roberts, 2008) so referring to use in another discipline may mean little. The way marketing investments are treated by financial accounting make AATQ especially problematic for marketing-related questions. For research in finance, the bias that we show may be mere noise if it does not relate directly to the hypothesis. Acceptability in finance would not mean AATQ are useful in marketing; metric choice must be justified for the question at hand.

Bendle and Butt, 2018, page 34

The Right Metric Depends Upon Its Planned Use

When using a metric one should say why it is good for your specific purpose not that a Nobel prize winner used it (to do something else entirely).

Read: Neil Bendle and Moeen Butt (2018), The Misuse of Accounting-Based Approximations of Tobin’s q in a World of Market-Based Assets, Marketing Science, https://pubsonline.informs.org/doi/10.1287/mksc.2018.1093

A slightly earlier version of our paper is here for those who don’t subscribe to Marketing Science: The Misuse of Tobins q Submitted Jan 2018 v2